Business ethics and environmental standards

As a development-oriented group of banks, we continuously evaluate the relevance of our actions with regard to our concept of development, which goes well beyond the traditional notion of economic growth. Rather, it is related to a broader sense of responsibility towards the countries in which we operate.

We as the ProCredit group continuously assess our actions and decisions, not only from the perspective of profitability and our clients’ needs, but also and above all against the impact they might have on society and the environment around us.

In this respect, we take part in various initiatives, such as:

UN Environment Programme Finance Initiative (UNEP FI)

The United Nations Environment Programme Finance Initiative (UNEP FI) is a partnership between the United Nations Environment Programme and the global financial sector to promote sustainable finance. The UNEP FI brings together banks, insurers, and investors to catalyse action across the financial system, supporting the transition to more sustainable and inclusive economies worldwide. The initiative focuses on key themes such as climate change, pollution, and circular economy, providing guidance and tools to help financial institutions manage sustainability risks and opportunities. By fostering collaboration and innovation, the UNEP FI aims to drive systemic change and foster a resilient global economy. This partnership enables ProCredit to contribute to the Sustainable Development Goals and address climate change through initiatives like green lending and carbon accounting. Under this initiative, we participate in the Finance Leadership group on Plastics.

Principles for Responsible Banking (PRB)

The Principles for Responsible Banking (PRB) are a framework developed by UNEP FI to guide banks in aligning their business strategies with societal goals, including the Paris Agreement and the Sustainable Development Goals . By implementing the PRB, banks commit to embedding sustainability at the strategic, portfolio, and transactional levels. This involves setting and publishing targets, taking action to achieve them, and reporting on progress. The PRB provides a comprehensive approach for banks to manage environmental, social, and governance risks and opportunities, ensuring that their operations contribute positively to society and the environment. As a member of the UNEP FI, ProCredit integrates these principles into its operations, focusing on transparency, social responsibility and environmental sustainability. More information about our contributions can be found in the Impact Report Datasheet.

Science Based Targets initiative (SBTi)

The Science Based Targets initiative (SBTi) is a global organisation that enables companies and financial institutions to set ambitious, science-based emissions reduction targets. The SBTi provides standards, tools, and guidance to help businesses align their greenhouse gas emissions reductions with the latest climate science, aiming to keep global heating below catastrophic levels. The initiative’s Net-Zero Standard defines best practices for achieving net-zero emissions by 2050, encouraging companies to take bold climate action. By setting and validating science-based targets, businesses can drive innovation, improve investor confidence, and contribute to the global effort to combat climate change. The SBTi’s rigorous validation process ensures that targets are credible and aligned with the goals of the Paris Agreement. As part of this global push, the ProCredit group has committed to setting its future near- and long-term emissions reductions in accordance with the SBTi’s initiative (SBTi) Net-Zero Standard, in line with the Business Ambition for 1.5°C and the United Nations Framework Convention on Climate Change’s Race to Zero campaign. The SBTi has validated ProCredit Holding’s near-term targets as science-based: The group is committed to reducing its Scope 1 and 2 emissions by 42% in the near future. Additionally, ProCredit aims to engage with the clients responsible for 28% of its portfolio emissions to set their own science-based targets and to continue financing only renewable energy projects.

2X Global

2X Global is a global membership and field-building organisation dedicated to advancing gender-smart investing and intersectional investment agendas. The initiative brings together investors, capital providers, and intermediaries from both developed and emerging economies to facilitate the deployment of capital through gender lens investments. 2X Global engages its network through educational forums, certification programmes, and deal-sharing platforms, promoting standards and practices that enhance women’s economic participation and leadership opportunities. By mobilising billions in gender lens investments, 2X Global aims to create a more inclusive and equitable financial system, demonstrating the positive impact of diversity on business performance and societal well-being. ProCredit’s membership in 2x Global emphasises its commitment to advancing gender equality and fostering inclusive finance. In this way we are supporting women-led businesses and reducing gender-based barriers in finance.

United Nations Global Compact (UNGC)

The United Nations Global Compact (UNGC) is the world’s largest corporate sustainability initiative, encouraging businesses to adopt sustainable and socially responsible policies. By joining the UNGC, companies commit to aligning their operations with ten principles in the areas of human rights, labour, the environment, and anti-corruption. These principles are derived from key UN declarations and conventions, providing a framework for responsible business practices. The UNGC supports companies in implementing the Sustainable Development Goals (SDGs) through various programmes and resources, fostering collaboration and innovation. Participation in the UNGC for sustainable and responsible corporate governance underscores ProCredit’s commitment to strategically anchoring sustainability and to contributing to the implementation of the SDGs by adopting the ten principles of the UNGC.

Partnership for Carbon Accounting Financials (PCAF)

The Partnership for Carbon Accounting Financials (PCAF) is a global partnership of financial institutions that work together to develop and implement a harmonised approach to assess and disclose the greenhouse gas (GHG) emissions associated with their loans and investments. The PCAF provides the Global GHG Accounting and Reporting Standard for the Financial Industry, enabling transparency and accountability in measuring financed emissions. By adopting PCAF standards, financial institutions can set science-based targets and align their portfolios with the Paris Climate Agreement. The PCAF’s methodologies help institutions manage climate risks, identify opportunities, and contribute to the global effort to achieve net-zero emissions. As part of our own efforts to assess the Scope 3 emissions stemming from our loan portfolio as well as to quantify climate risks and limit our impact on climate change, the ProCredit group has set itself the task of measuring and disclosing the greenhouse emissions associated with its lending activities and investments in accordance with PCAF standards.

Joint Impact Model (JIM)

The Joint Impact Model (JIM) is a non-profit platform that enables financial institutions to measure and disclose the economic, social, and environmental impacts of their investments. The JIM uses input-output modelling to quantify indirect jobs, value added, and greenhouse gas emissions related to investment portfolios. The model provides a harmonised and transparent methodology, aligning with industry standards such as ISSB S2, EU SFDR, and PCAF. By using the model, institutions can assess portfolio climate risk and report on their contributions to the Paris Agreement and the Sustainable Development Goals. The JIM aims to unlock sustainable finance in developing countries, fostering accountability and comparability in impact measurement. Aiming to achieve comparability, accountability, and transparency in the measurement of key impact indicators in a harmonised manner, the ProCredit group joined the JIM and began quantifying indirect jobs and value added of its investments.

Financial Alliance for Women

ProCredit is proud to be a member of the Financial Alliance for Women, a global network dedicated to championing the female economy. This alliance brings together financial organisations from over 135 countries to unlock the full value of the female economy, which is the world’s largest and fastest-growing market. By participating in this network, ProCredit gains access to peer learning, data and research, policy advocacy, and women-centred products and services. The alliance supports its members in building profitable and sustainable women’s market programmes, thereby enhancing women’s economic participation and leadership opportunities. Through this membership, ProCredit demonstrates its commitment to gender-smart investing and advancing intersectional investment agendas, contributing to a more inclusive and equitable financial system.

Our approach

ProCredit Impact Report Package 2024

Group statement on Human Rights / PDF 565 KB

Group Diversity, Equity, and Inclusion Strategy / 0.7 MB

Group Environmental Management Policy / PDF 3 MB

Group Climate Transition Plan / PDF 0.4 MB

Group Climate Action Strategy / PDF 0.6 MB

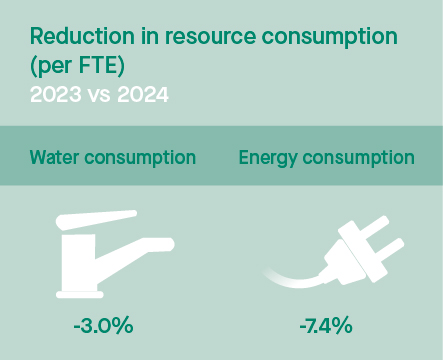

Our environmental performance

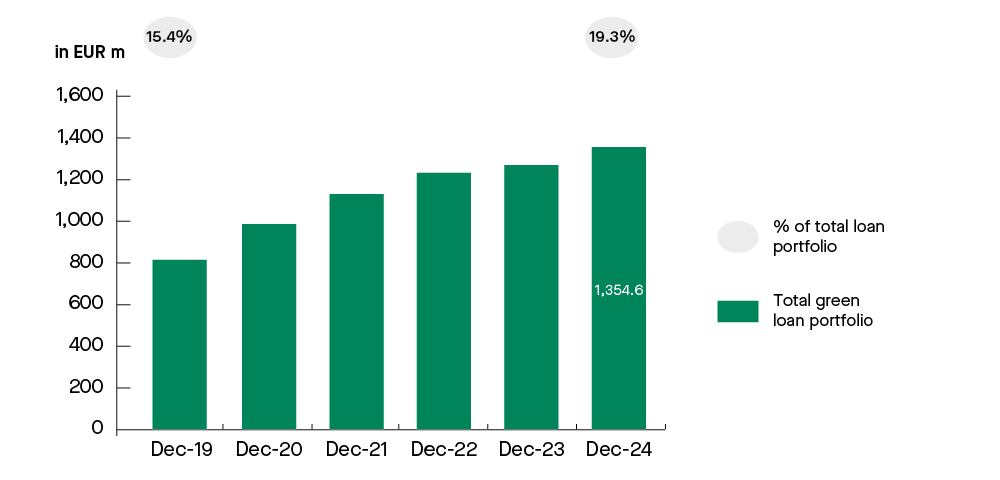

Our results in green finance

With our accumulated in-house expertise, we are perceived as pioneers in the countries in which we operate and our banks have positioned themselves as the partner of choice for green loans. Close cooperation with our clients allows us to understand and support them in their businesses. And, by bringing environmentally concerned businesses together, we provide a forum for discussion, knowledge-sharing and the exchange of ideas and best practices among our client group.

ProCredit group green loan portfolio development

Note: Continuing operations as per 31-Dec-2024

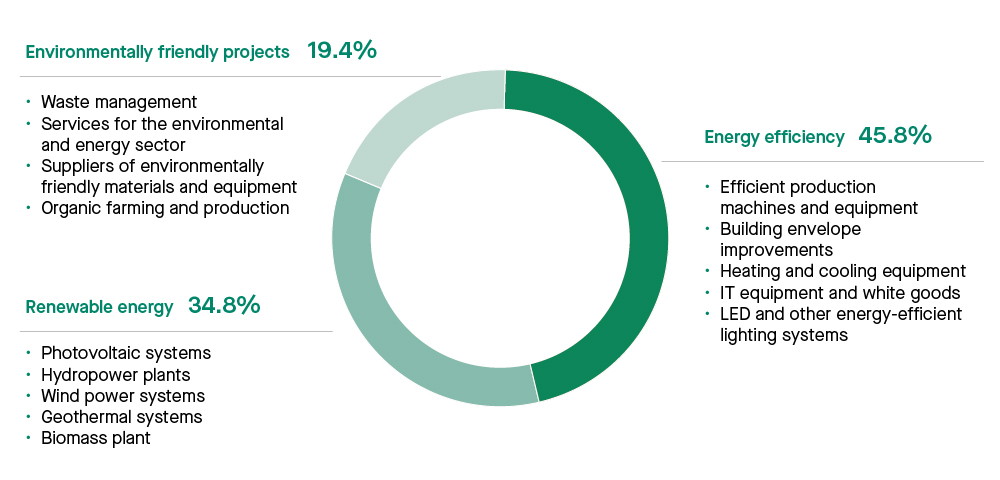

Green loan portfolio by investment type

Note: As per 31-Dec-2024

Our performance and external certification

In August 2022, all ProCredit institutions based in Germany were re-certified under the EU Eco-Management and Audit Scheme (EMAS) and ISO 14001:2009. The first certification was issued in 2016.