Key facts

ProCredit at a glance

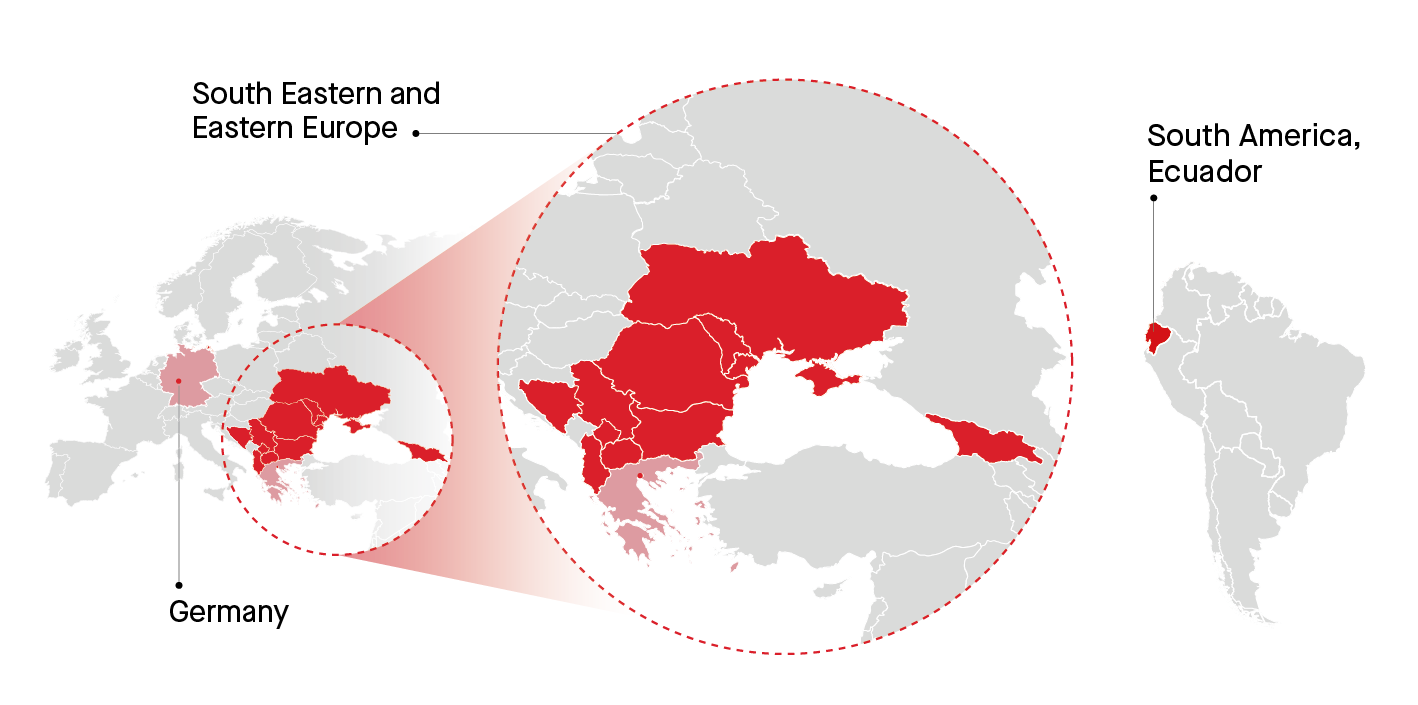

- An impact-oriented group of commercial banks with a focus on MSMEs and Private Clients in South Eastern and Eastern Europe

- “Hausbank” for MSMEs and ProCredit Direct for Private Clients

- Headquartered in Frankfurt and supervised by BaFin and Bundesbank

- Track record of high-quality loan portfolio based on prudent risk management and focus on long-term business relationships

- Profitable every year since creation as a banking group

Our Mission

We strive to be the leading MSME bank in our markets following sustainable and impact-oriented banking practices. Together with our fully digital offering to private clients, we want to generate long-term sustainable returns and create positive impact in the economies and societies we work in.

Regional footprint

Group Key Indicators

Statement of Profit or Loss

| (in EUR m) | 01.01. – 30.09.2025 | 01.01. – 30.09.2024 |

| Net interest income | 260.8 | 270.6 |

| Net fee and commission income* | 71.0 | 67.2 |

| Operating income | 323.7 | 330.7 |

| Personnel and administrative expenses | 230.8 | 217.2 |

| Loss allowance | 16.9 | 4.1 |

| Profit of the period | 58.2 | 84.8 |

*Previous year figures have been adapted to the current disclosure structure.

Key Performance indicators

| 01.01. – 30.09.2025 | 01.01. – 30.09.2024 | |

| Change in loan portfolio | 7.9% | 9.0% |

| Cost-income ratio | 71.3% | 65.7% |

| Return on equity (annualised) | 7.4% | 11.3% |

| 30.09.2025 | 31.12.2024 | |

| CET1 ratio (fully loaded) | 13.0% | 13.1% |

Additional indicators

| 30.09.2025 | 31.12.2024 | |

| Deposit to loan portfolio ratio | 113.9% | 118.3% |

| Net interest margin (annualised) | 3.2% | 3.5% |

| Cost of Risk (annualised) | 31 bp | -8 bp |

| Share of defaulted loans | 2.1% | 2.3% |

| Stage 3 loans coverage ratio | 50.0% | 49.9% |

| Green loan portfolio (in EUR m) |

1,411.8 | 1,354.6 |

Ratings

| FitchRatings | Long term rating (outlook) | BBB (stable) |

| MSCI ESG Research | ESG rating | A |

| ISS ESG | Corporate rating | Prime |